Macro-Economic Background

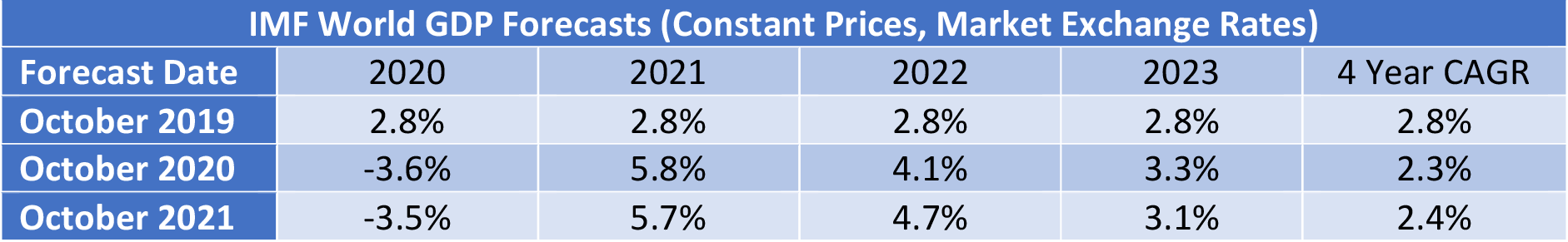

For this report we have looked at the IMF’s World GDP forecasts in a slightly longer-term context. October 2019 lends itself to the role of base case showing a steady 2.8% growth every year through 2023. This and subsequent forecasts show growth around this level from 2024 onwards, so the real variability is in the years 2020-2023. Both the 2020 and 2021 forecasts show a modest drop in CAGR relative to 2019, but with the recovery in the 2021 forecast more concentrated in 2022. The good news is that the anticipated 2021 recovery has happened despite the continuing impact of the pandemic and global supply chain problems.

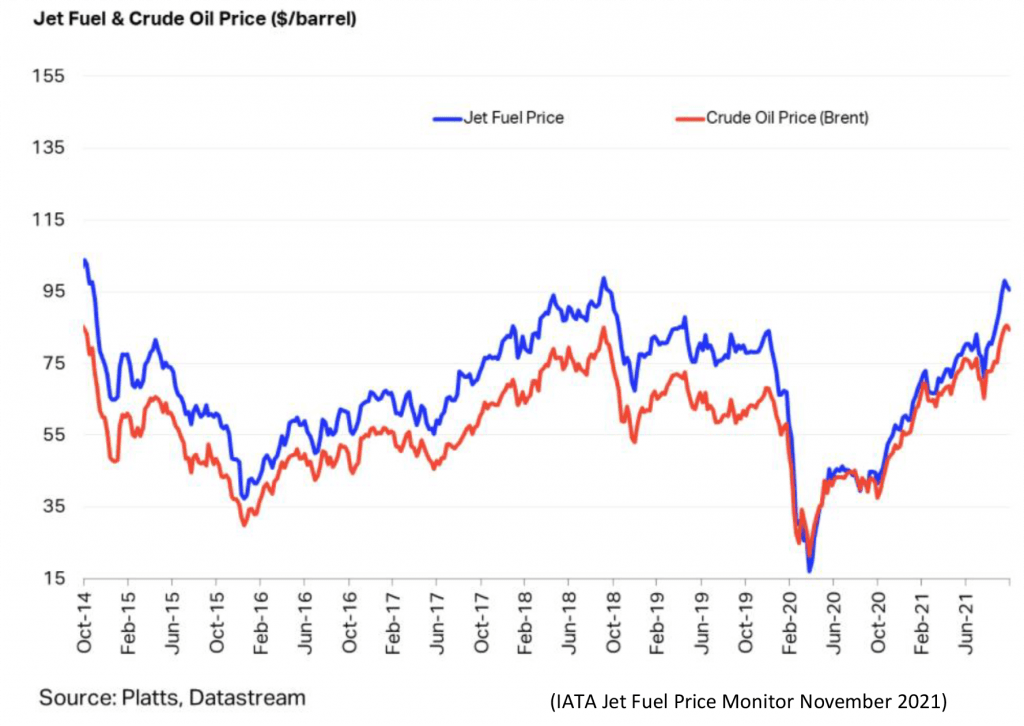

The price of jet fuel continued to increase in Q3 2021, driven by the increase in the price of crude oil and by the return of the “crack spread” to more normal historical levels. Today’s price is at levels last seen in 2018, which was a good year for the airline industry so one would not expect very negative consequences. However, it will reduce the airlines’ financial flexibility and at the margin will encourage them to prioritize profit margins over traffic growth as it will increase their break-even load factor.

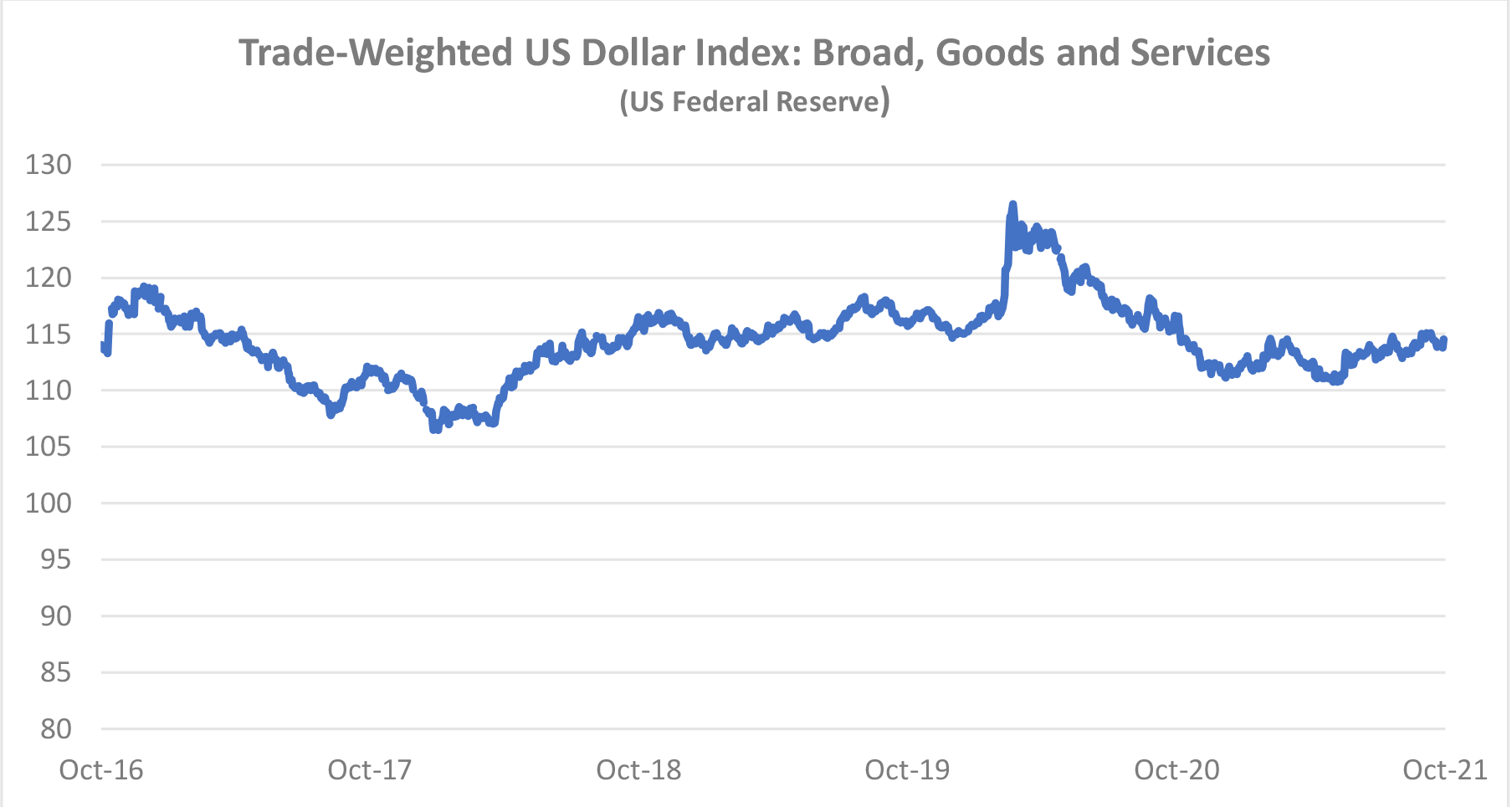

For airlines outside of the US this negative continues to be offset by a weaker US Dollar. This is a very important factor in airline financial performance because so many airline costs are typically US Dollar-denominated – not just fuel but also aircraft rents, debt service, aircraft, and spare parts.

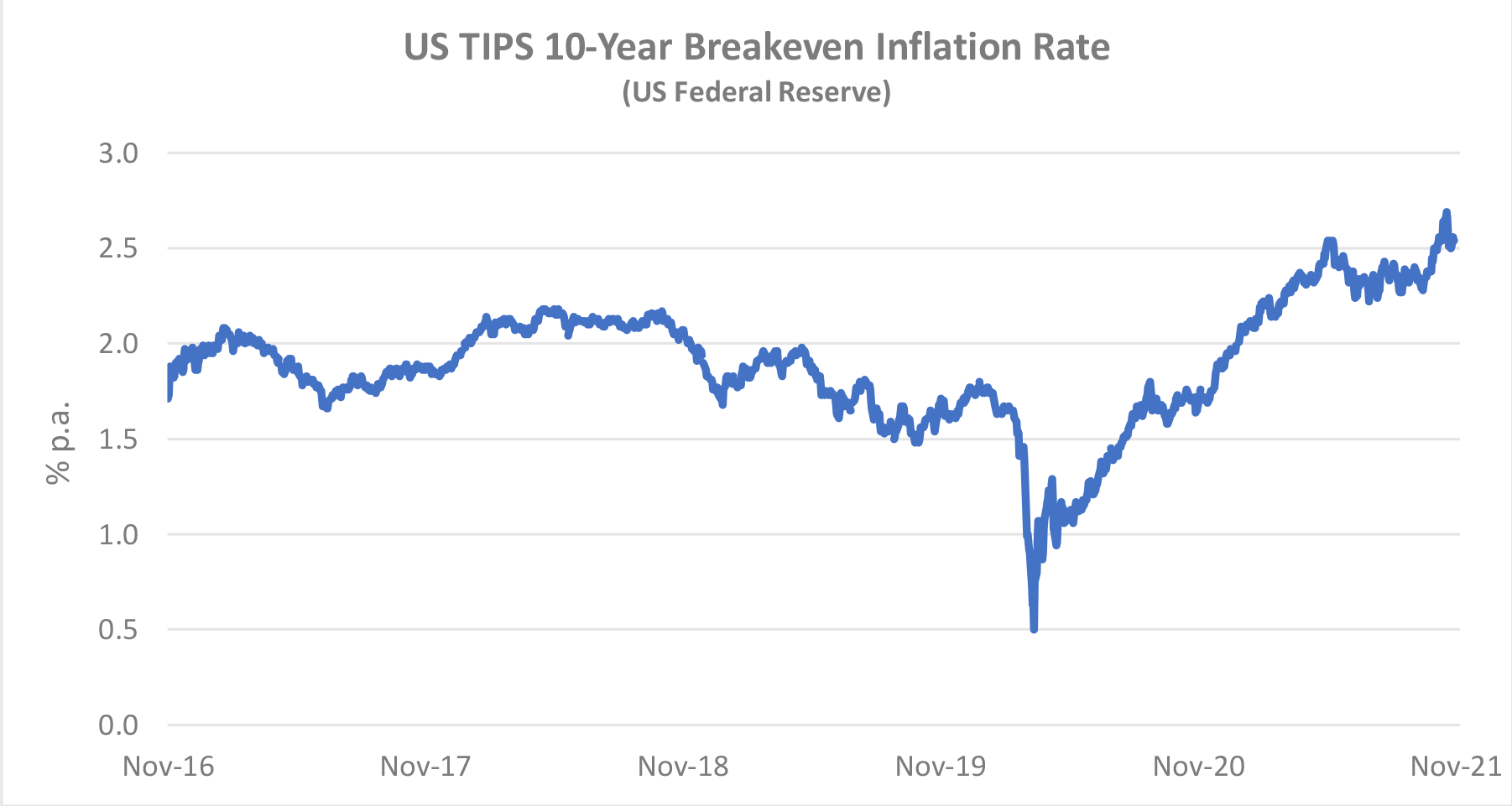

Another indicator that is potentially important to aircraft investors is the breakeven inflation rate on US Treasury Inflation-Protected Securities (TIPS). This indicator measures inflation expectations and it matters because used aircraft values are strongly influenced by the cost of new aircraft and over time this cost is linked to US Dollar inflation. In the short term this linkage is driven by escalation clauses in aircraft purchase contracts and in the long term by the general input cost environment for the aircraft manufacturers. There has been a sharp and sustained increase in inflation expectations on a ten-year time horizon in the last twelve months.

Traffic and Aircraft Demand

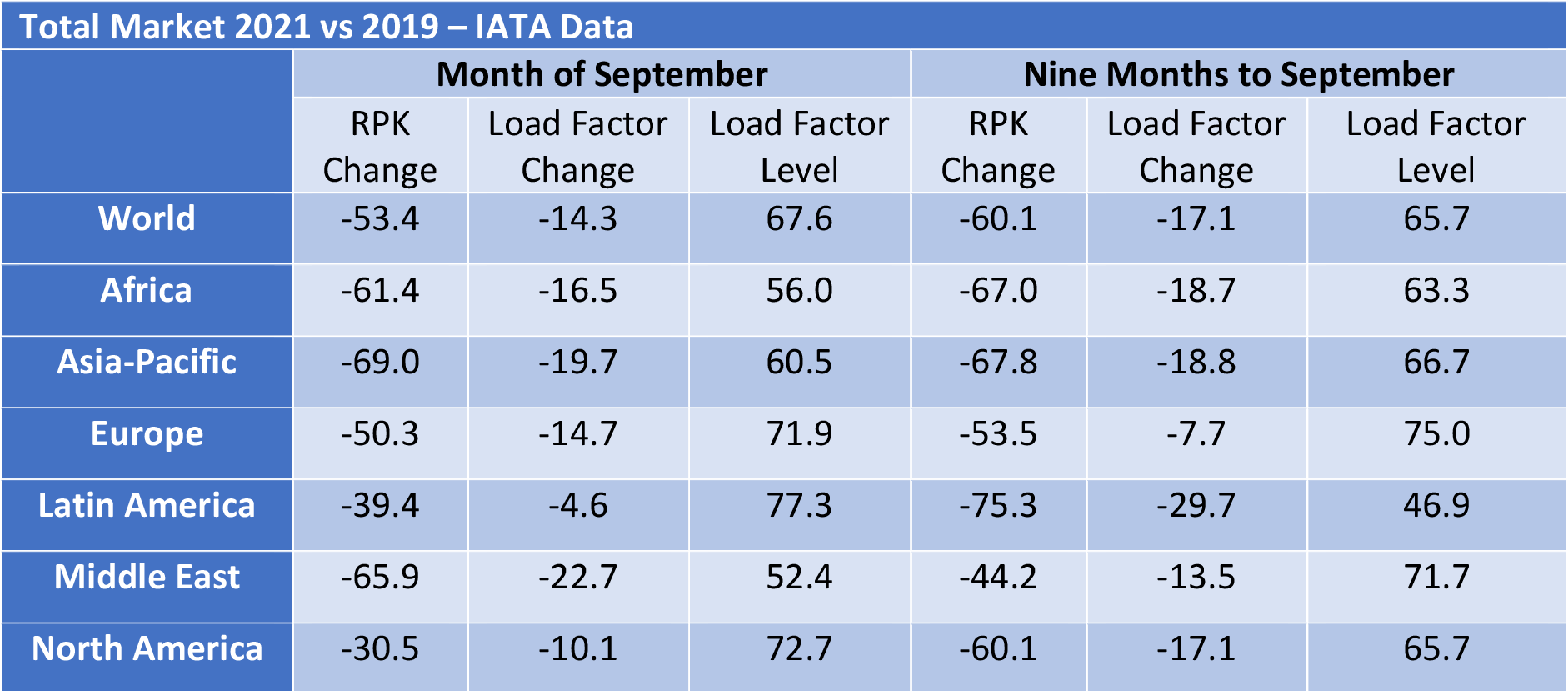

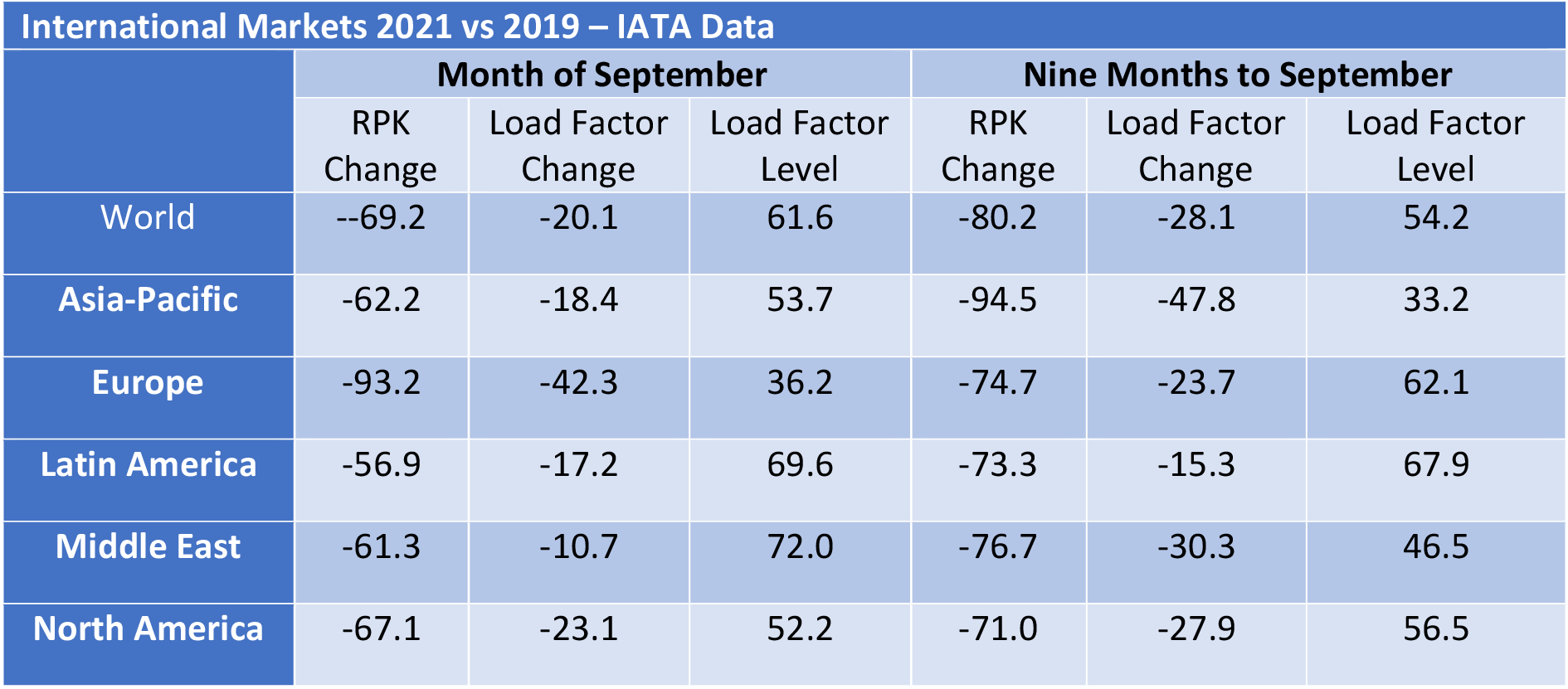

Recovering from the impact of COVID-19 remains slow and patchy. Global RPKs for the nine months to September 2021 were down 60% vs 2019 compared to a 67% drop for the six months to June. As the tables below make clear domestic traffic continues to outperform international by a large margin due to the greater impact of government restrictions on the latter. The US have just reopened their market to non-essential travel which is a significant positive, but this development will be more relevant to 2022 than 2021

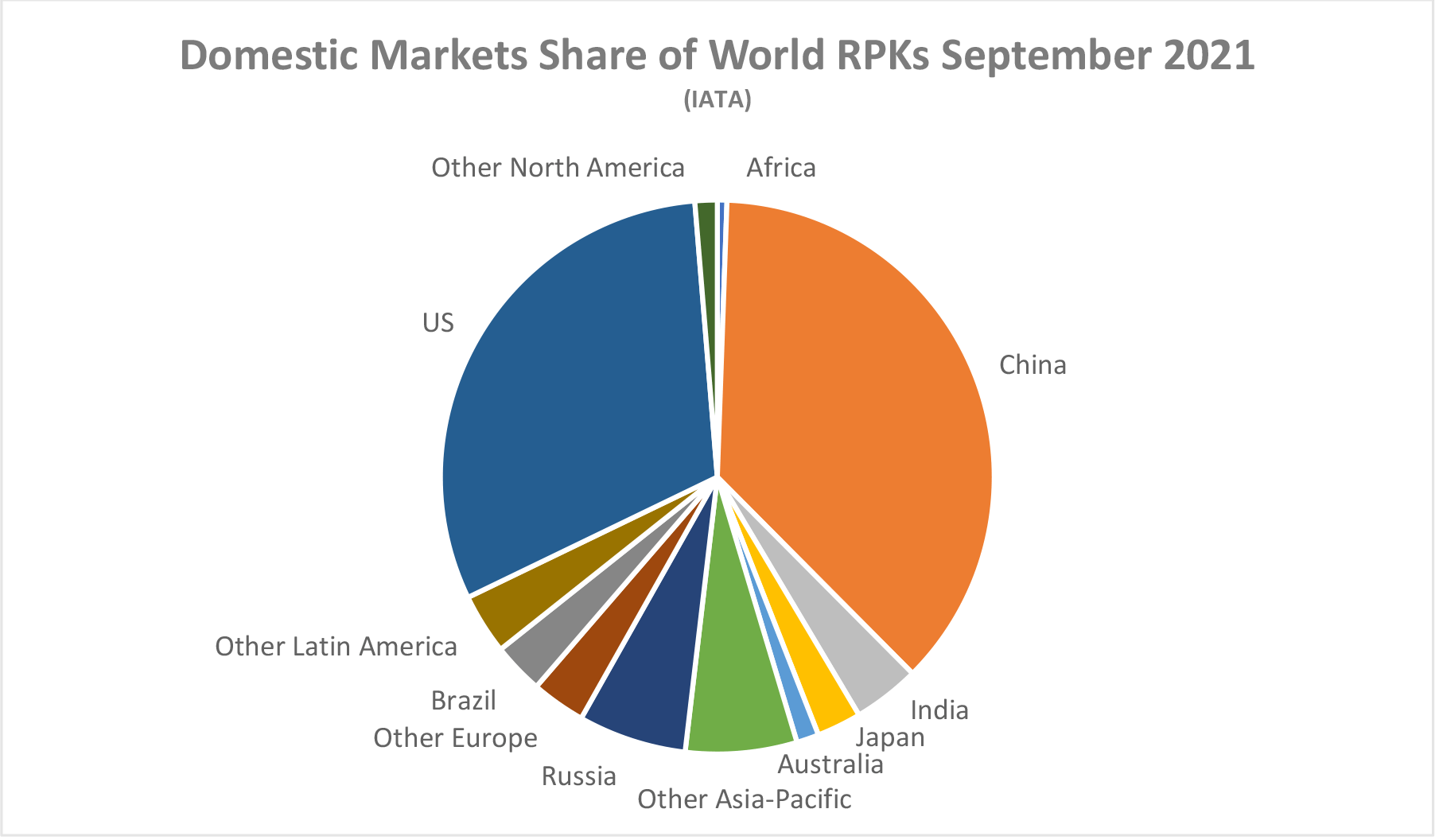

IATA reports changes in traffic and global market shares rather than actual values and reports domestic traffic on a different basis to international traffic by focusing on country rather than regional markets. The country focus becomes more understandable when one considers the large share of total domestic traffic accounted for by the seven countries listed whose combined share of domestic traffic is over 80%.

Although the breakdown of domestic traffic in 2021 looks similar to 2019, this is not true of the breakdown of domestic and international traffic by region. Although domestic traffic has an increased share everywhere, the change is most dramatic in the Asia-Pacific region where international traffic has collapsed, and domestic Chinese traffic is most of what’s left.

Although some short-haul aircraft serve international routes nearly all long-haul aircraft do so, and this is reflected in the relative demand for single-aisle (narrowbody) and twin-aisle (widebody) aircraft. Aircraft demand can be measured in terms of ASKs and aircraft in service. ASKs have not declined as much as traffic because load factors have declined and aircraft in service have not declined as much as ASKs because aircraft utilization has declined. The airlines are clearly sweating their assets more since the middle of 2021 as the rates of growth in both ASKs and aircraft in service have both declined. This is probably due to a more stable market environment and the need to address rising fuel prices with greater asset productivity.

New Aircraft Supply

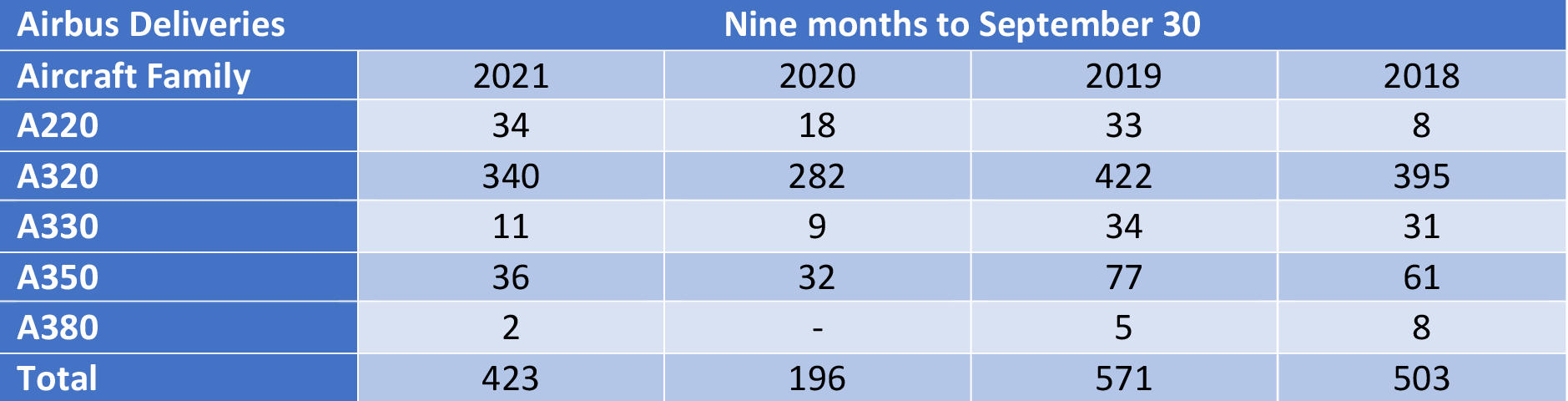

Airbus announced the following changes in production plans:

- • A320 family production rate to increase from 64 aircraft per month to 65 in mid-2023

- • A350 family production rate to increase from 5 to 6 per month in early 2023 rather than late 2022

Airbus is reported to have received written objections from some of its major lessor customers after announcing that it is considering an increase in A320 family production to 75 aircraft per month in 2025. It is also believed that key members of its supply chain such as engine manufacturers are not enthusiastic either. One might speculate that Airbus is testing the waters with some of its key stakeholders and signalling that intends to maintain its lead in the single-aisle aircraft market.

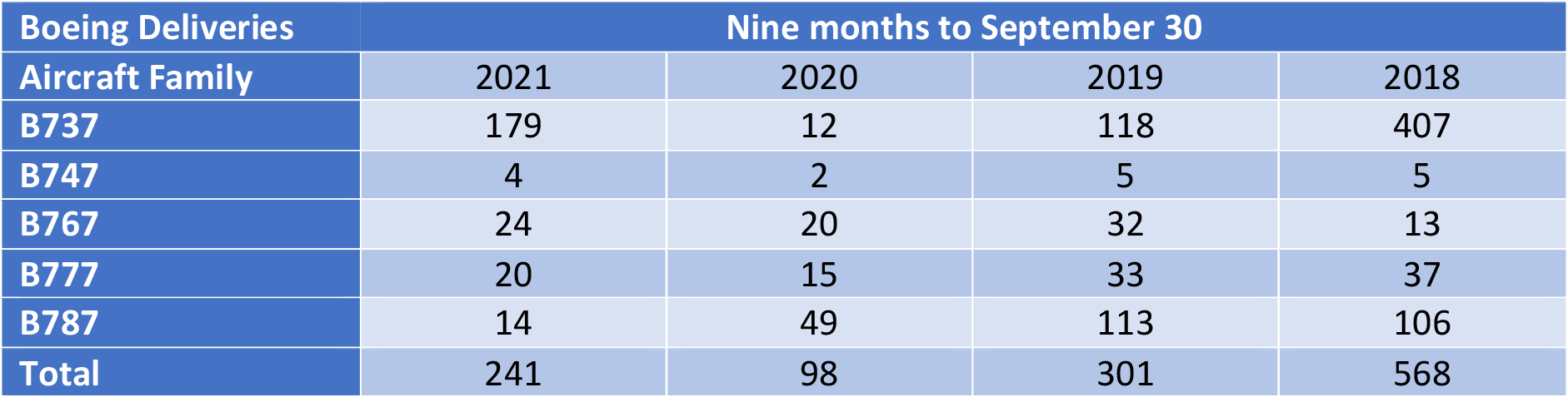

Boeing has delivered roughly 150 of the 450 B737 Max aircraft held in inventory before the type was recertified in November 2020. However, the B737 Max inventory was still around 370 at the end of September, implying that 70 new units have been manufactured but not yet delivered. This is probably due to a combination of delivery bottlenecks and delays in recertification in some jurisdictions, notably China. Inventory is expected to clear by 2023. Boeing is producing 19 aircraft per month and says it is on track to meet its target of 31 aircraft per month in early 2022. Management is considering further production increases but are wary of potential supply chain issues.

Boeing has also had quality and production problems with the B787, its main passenger twin-aisle product (nearly all B747, B767 and B777 deliveries are freighters or tankers) and has suspended deliveries. There are 105 B787s in inventory.

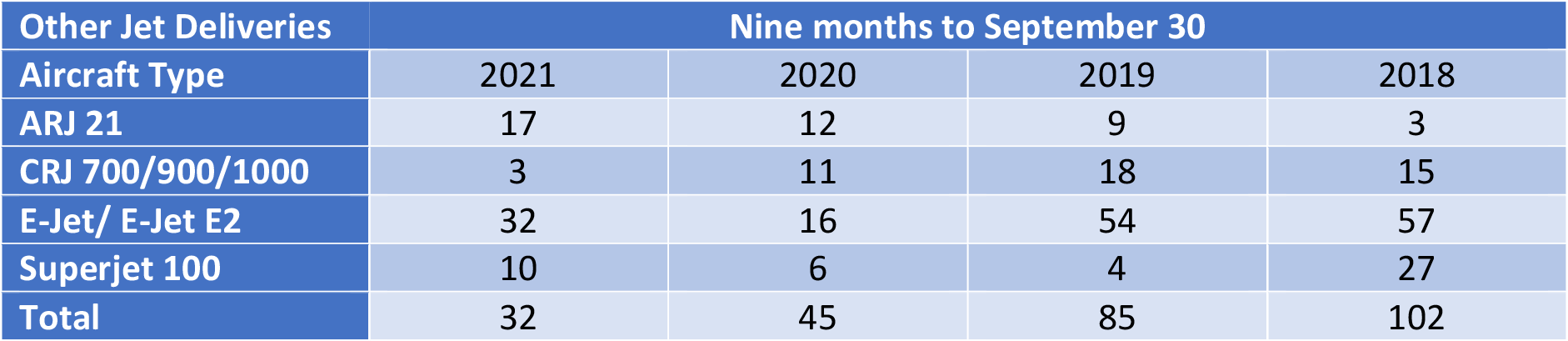

There has been an increase in the production of the ARJ 21 regional jet by COMAC and some degree of recovery in deliveries by Embraer and Sukhoi.

Airline Industry Financial Performance

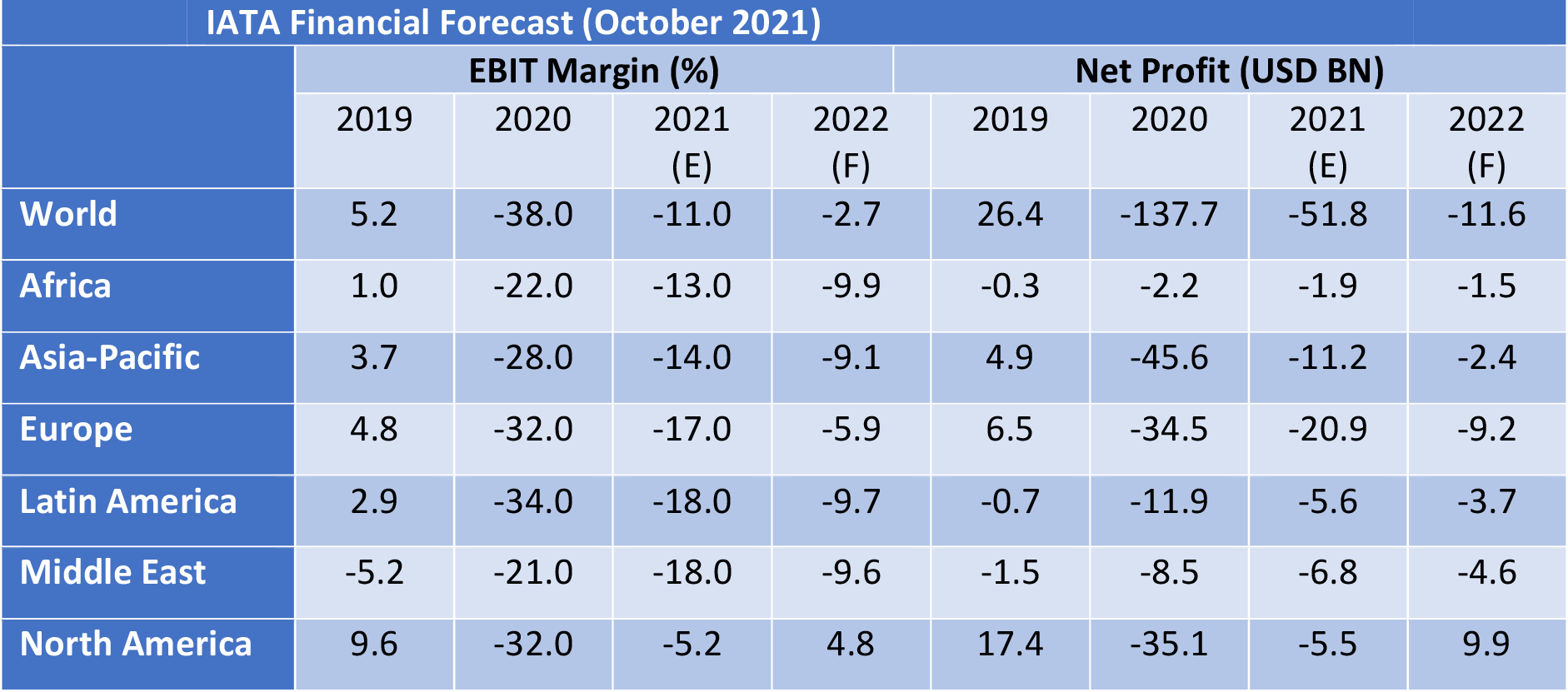

IATA’s new industry forecast shows the airline industry returning to a near breakeven in 2022 after another very difficult year in 2021. North America is set to be the first region to move back into profit and Europe is forecast to be the next best performer on an EBIT Margin basis. Europe’s relative performance is much better than in 2021 due to positive impacts of its Covid passport scheme and the re-opening of North Atlantic travel. Another factor in the global recovery is the reduction in price competition caused by airlines going out of business.

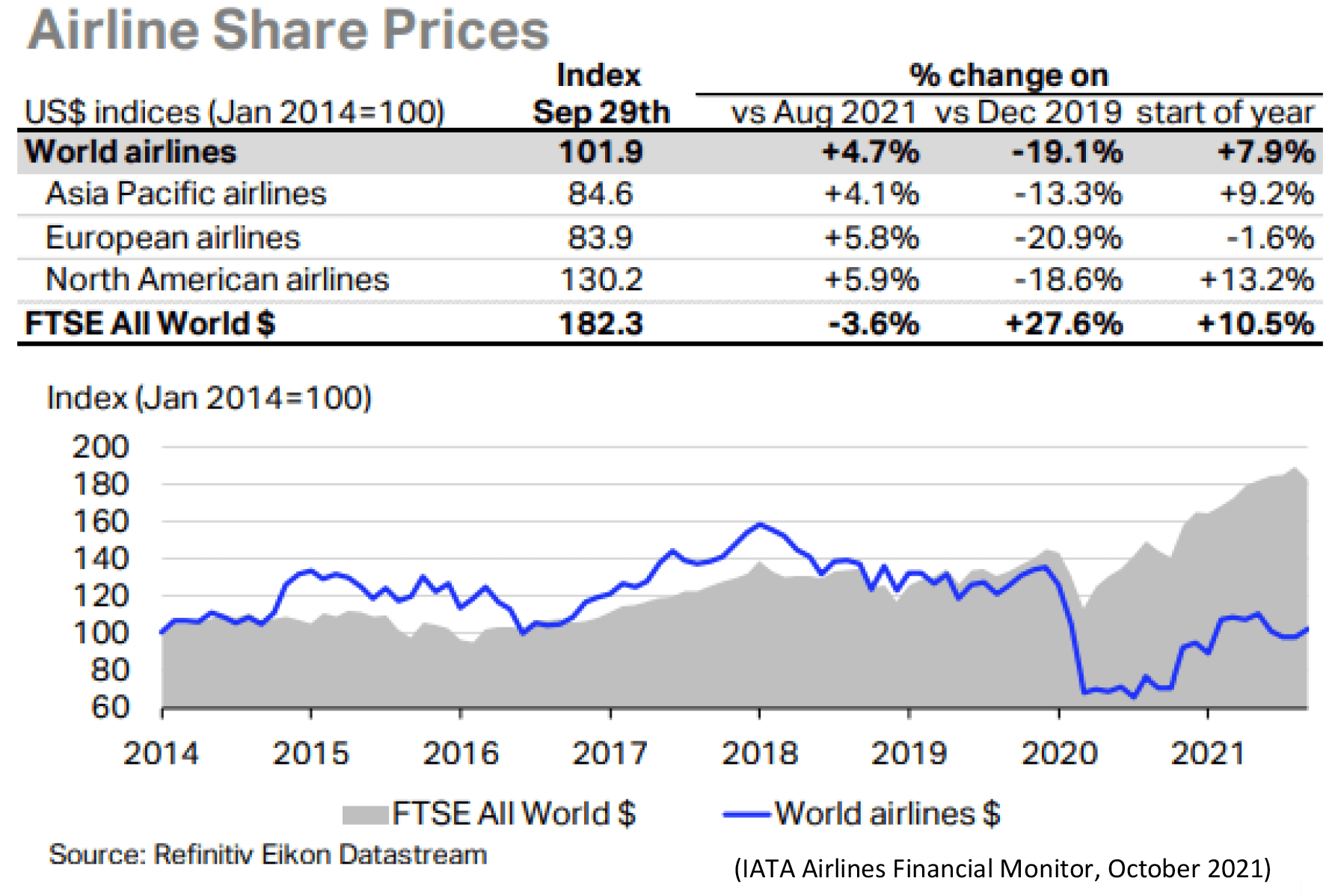

Airline share prices have recovered from their 2020 lows, but the chart below shows that they have underperformed the overall market. This is not surprising given the continued uncertainty over the timing of recovery and the probable requirement to strengthen balance sheets by issuing new equity at the cost of diluting existing shareholders.

There were no additional major airline bankruptcies in Q3 2021. Although there were reports in October that Air Madagascar will file for court protection according to Cirium Fleets Analyzer it only has one aircraft in its fleet. According to the aviation consultancy Ishka 23 airlines with 1,586 aircraft were under formal restructuring in October 2021, a small increase from July.

Aircraft Trading Update

Most aircraft trades take place between lessors and/or investors and involve aircraft subject to lease. Airline to airline trades are much less common and most aircraft sales without a lease in place are for freighter conversion or part-out.

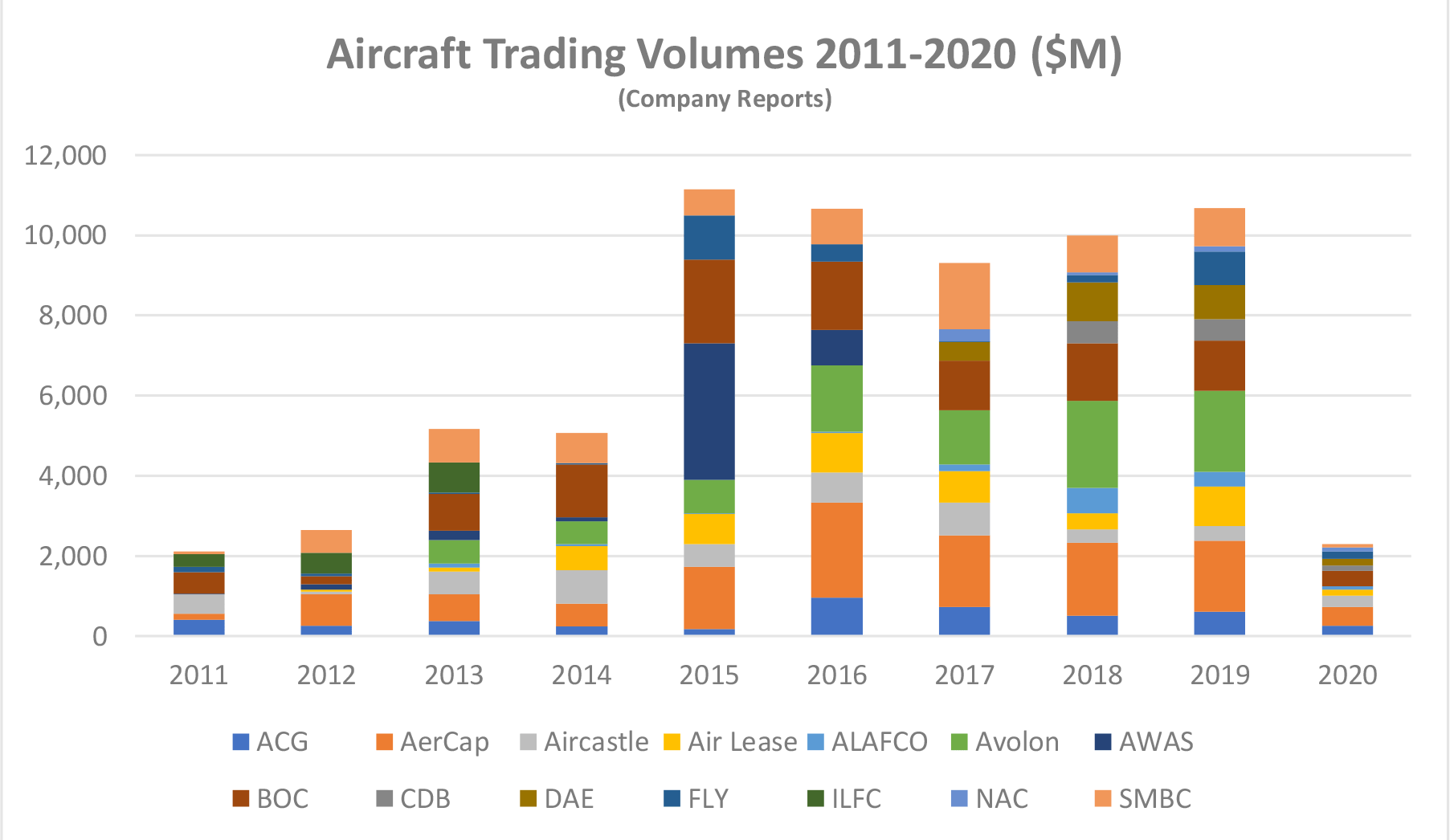

The most important sellers of aircraft subject to lease are the major lessors. The chart above shows us Dollar sales volumes for 14 major lessors over the last ten years where public financial information is available. The most important market participant where we lack data is GECAS, and if we make a reasonable estimate of their activity, it is likely that average annual aircraft sales volume from 2015 to 2019 was around $12 Billion.

Part of the reason for the increase in aircraft sales before 2020 is a change in the lessors’ approach to portfolio management. Before the financial crisis only ILFC had a stand-alone public credit rating and other lessors relied on a combination of shareholder funding, bank loans and aircraft ABS issues in the capital markets for their debt requirements.

Access to unsecured corporate debt has become increasingly attractive from a cost and operational point of view and most large lessors now have public credit ratings, even where they are majority owned by a major financial institution (examples include BOC Aviation, CDB Aviation and SMBC Aviation Capital). The rating agencies focus on fleet age as a key metric for business risk, and this means that lessors now sell aircraft to manage their fleet age as well as to generate trading profits.

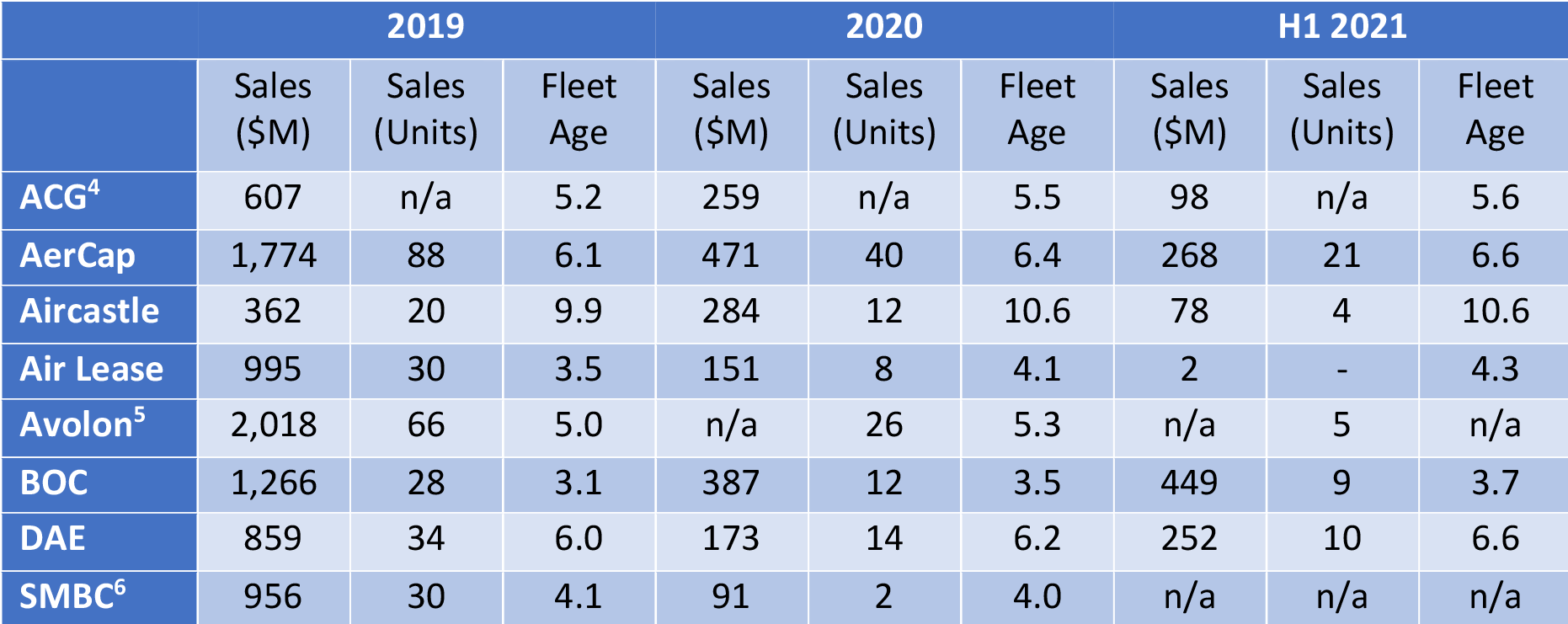

The table above provides more detail on the lessors most active as sellers of aircraft. We do not have full data due to differences in disclosure policies, but one can make some observations all the same:

- Aggregate sales activity dropped significantly in 2020 and H1 2021, both in terms of US Dollar volumes and units.

- In all but one case fleet age (average age weighted by net book value) has increased. The impact of the ageing of existing aircraft has been partly offset by the impact of new purchases.

- The reaction of different lessors to the impact of the pandemic has varied. Some have maintained a relatively high level of sales activity whereas others have virtually sat out the downturn. It should be emphasised that all the large lessors have high levels of liquidity and do not sell aircraft at a loss, although they do suffer non-cash asset impairments.

We believe that another reason for the decline in sales activity is the widespread granting of rental deferrals to airlines to improve their cash flow during the pandemic. This has an impact because it is a standard term of aircraft sales agreements that where an aircraft is subject to lease the payments on the lease must be up to date. Even if a potential buyer were willing to waive this requirement the transaction would require the airline to agree a novation agreement and this process would be much more challenging in the context of negotiating a deferral. This has limited the number of aircraft available for sale and has meant that there has been more competition amongst buyers in 2021 vs 2020.

As the airline industry recovers, we believe that the major lessors will seek to catch up with the level of sales they were contemplating before the pandemic and will offer aircraft portfolios to the market with a broader range of airline credits and aircraft types than in the last 18 months.

Disclaimer

This document is for informational purposes only. It is not intended as advice or a recommendation with respect to any transaction. The recipient of this document shall be solely responsible for making its own independent investigation and appraisal of any transaction. No market or company data or other information is warranted or guaranteed by Sirius Aviation Capital as to its completeness, accuracy, or fitness for a particular purpose, express or implied, and such data and information are subject to change without notice. Any comments or statements made herein reflect the assumptions, views, and analytical methods of the persons that prepared this document as of its date of preparation, and do not necessarily reflect the views of Sirius Aviation Capital. Sirius Aviation Capital may have issued, and may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Sirius Aviation Capital specifically disclaims any obligation to update this document, or any comments or statements contained herein.