Macro-Economic Background

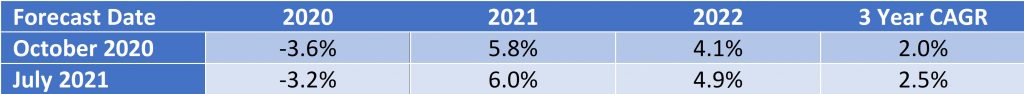

In its latest World Economic Outlook (July 2021) the IMF has produced a significantly more optimistic GDP forecast than in October 2020. Given the well-established correlation between world GDP and air traffic growth this upgrade is a significant positive for industry recovery.

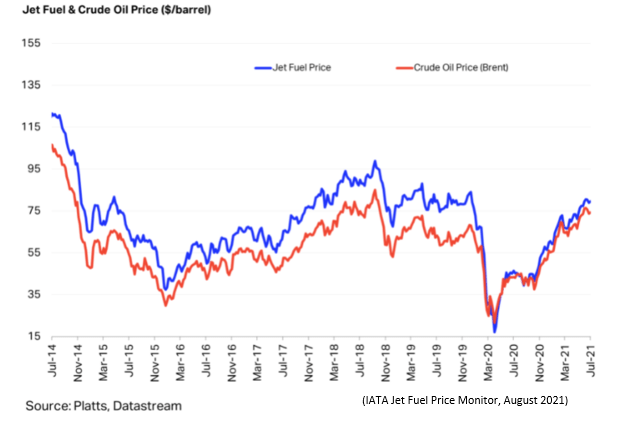

There has been an increase in the price of jet fuel since early 2020. Although this will not stop airlines’ return to profitability it decreases the industry’s financial flexibility.

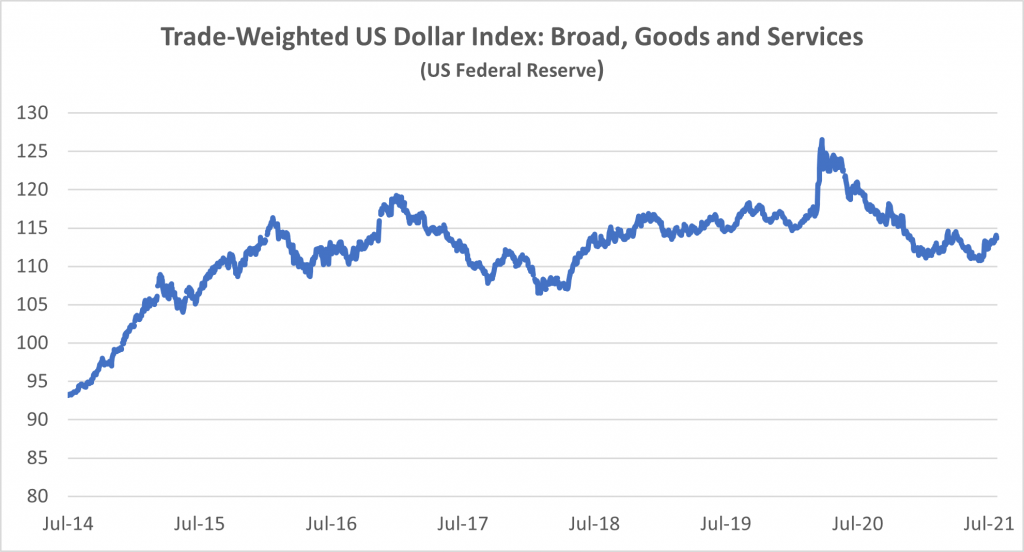

For airlines outside of the US this negative had been partly offset by a weakening of the US Dollar. This is a very important factor in airline financial performance because so many airline costs are typically US Dollar-denominated – not just fuel but also aircraft rents, debt service, aircraft, and spare parts.

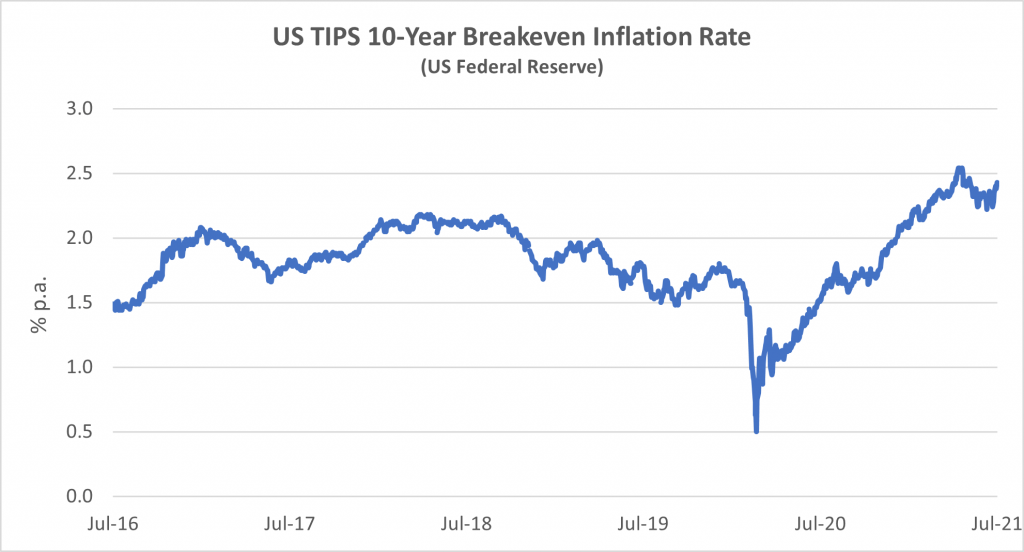

Another indicator that is potentially important to aircraft investors is the breakeven inflation rate on US Treasury Inflation-Protected Securities (TIPS). This indicator measures inflation expectations and it matters because used aircraft values are strongly influenced by the cost of new aircraft and over time this cost is linked to US Dollar inflation. There has been a sharp increase in inflation expectations relative to recent years.

Traffic and Aircraft Demand

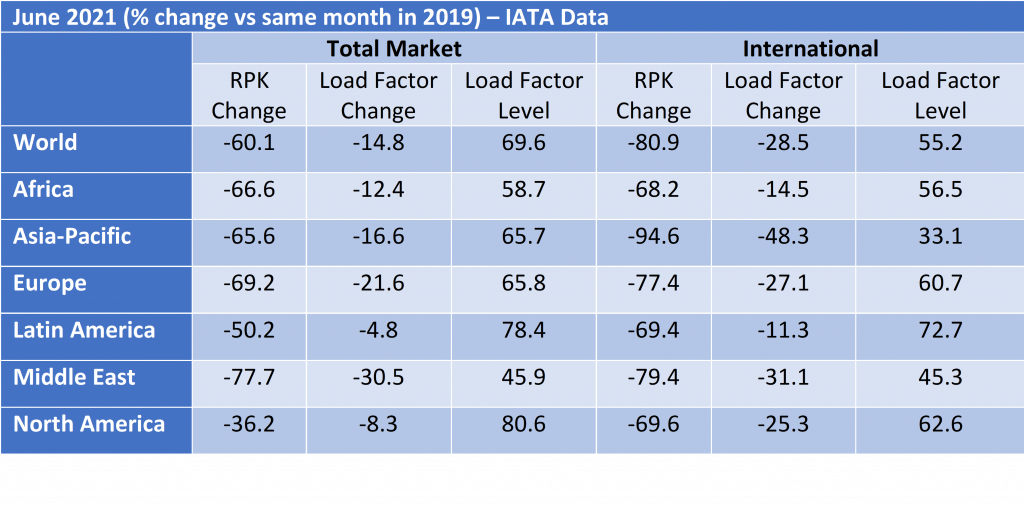

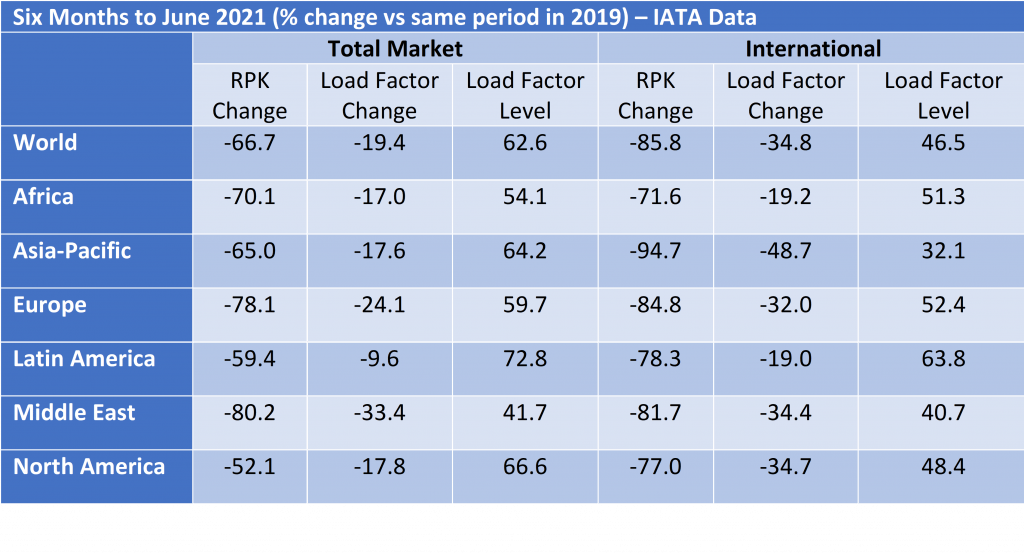

Recovering from the impact of COVID-19 is proving a painfully slow process for the airlines. IATA’s June traffic figures show an improvement relative to 2019 compared to the first half of 2021 overall, but the situation remains much more difficult than any downturn before 2020.

There remains a major difference between trends in domestic and international traffic. Large domestic markets such as the US and China have shown a much stronger recovery than the total market with June 2021 RPKs down only 15% and 11% respectively vs 2019. The biggest challenge for international travel remains a complex and ever-changing web of government regulations. There are some signs of a more constructive approach such as the EU Vaccine Passport scheme which should facilitate a recovery on short-haul international routes in Europe.

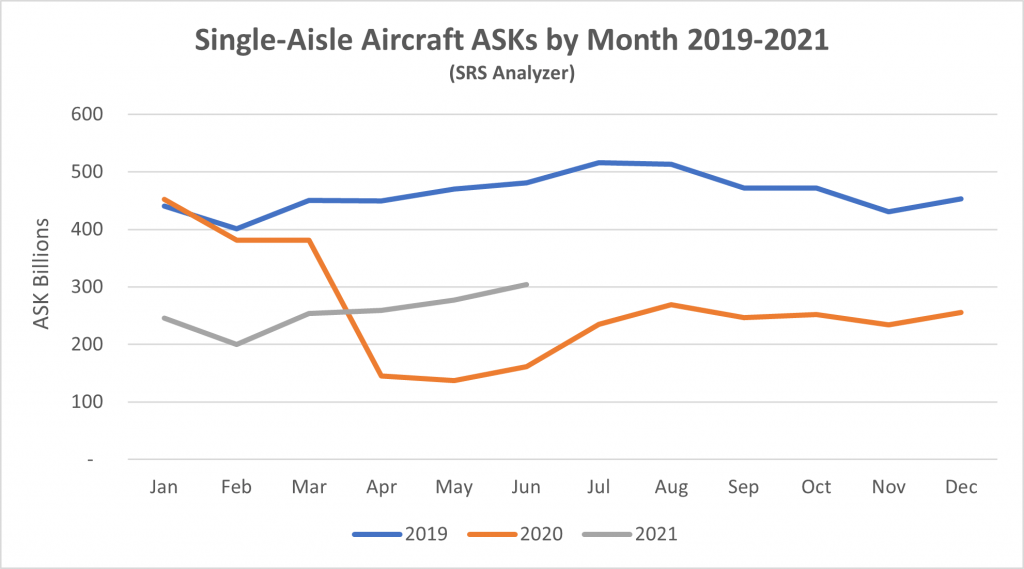

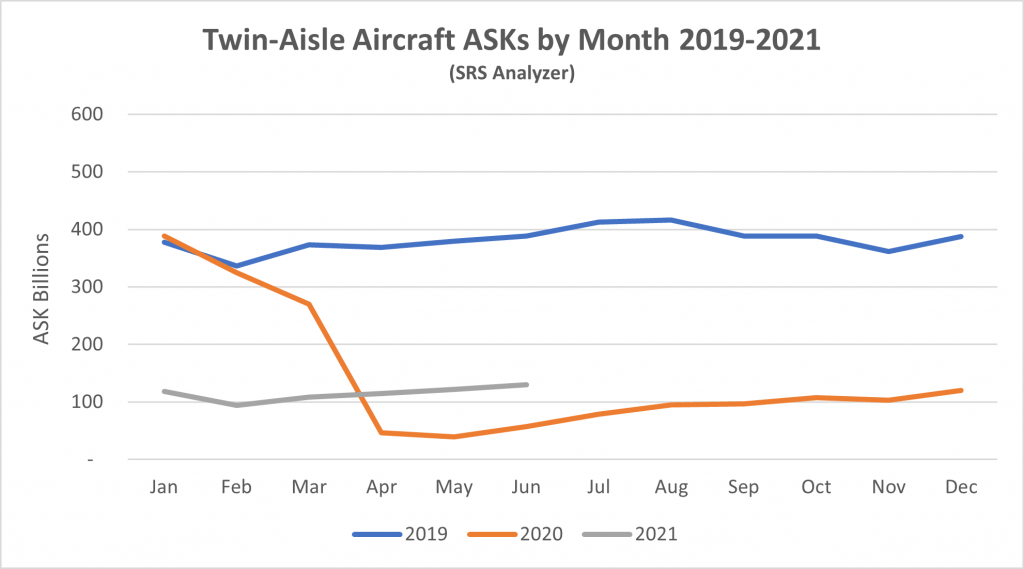

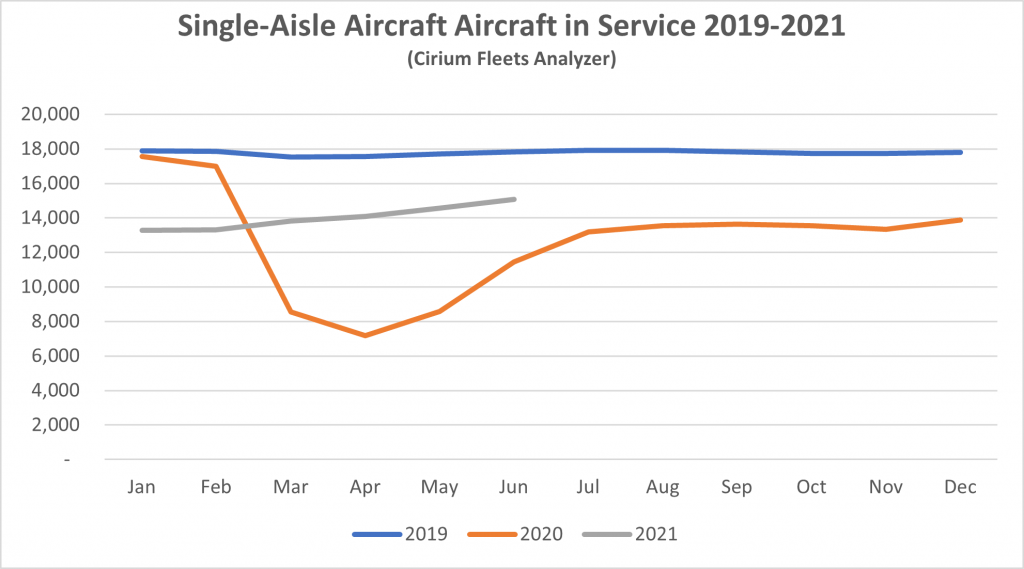

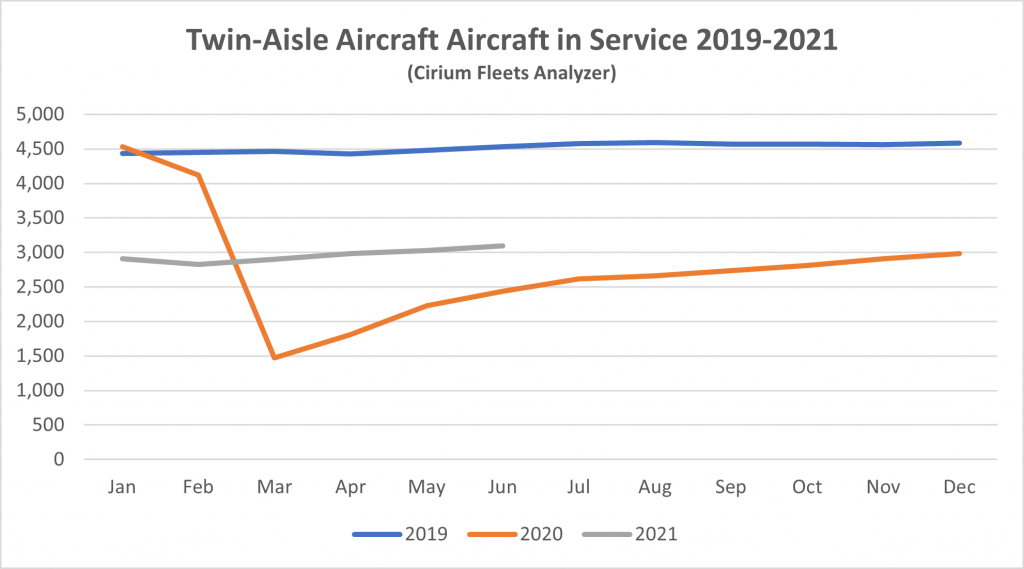

Although some short-haul aircraft serve international routes nearly all long-haul aircraft do so, and this is reflected in the relative demand for single-aisle (narrowbody) and twin-aisle (widebody) aircraft. Aircraft demand can be measured in terms of ASKs and aircraft in service. ASKs have not declined as much as traffic because load factors have declined and aircraft in service have not declined as much as ASKs because aircraft utilization has declined. Airlines have been able to live with the resultant decline in asset productivity to a certain extent because lower fuel prices and a weaker US Dollar have reduced their unit costs.

New Aircraft Supply

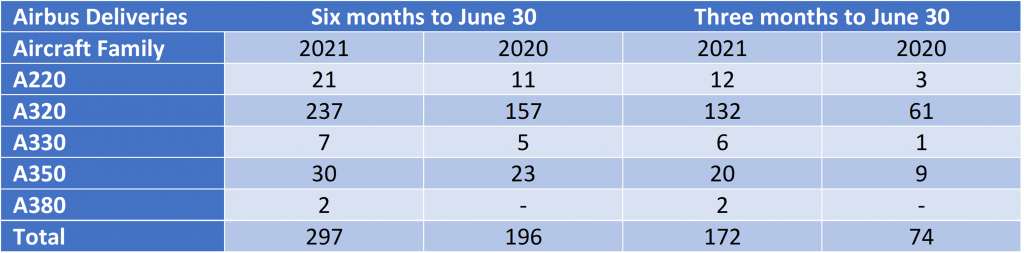

Airbus announced detailed guidance on its future production plans in May 2021 as follows:

• A220 currently at 5/mo rising to 6/mo in early 2022

• A320 currently at 40/mo rising to 45/mo in Q4 2021 and 64/mo by Q2 2023

• A330 currently at 2/mo and no planned changes

• A350 currently at 5/mo increasing to 6/mo in autumn 2022

We do not believe that Airbus has a material number of aircraft in inventory. All planned increases in production are very modest except for the A320 family which is likely to maintain a high market share in the single-aisle market. Boeing does not have a strong competitor to the A321Neo, the largest aircraft in the A320 family which accounts for nearly half its deliveries.

Airbus also recently announced that it is considering the development of a freighter version of the A350.

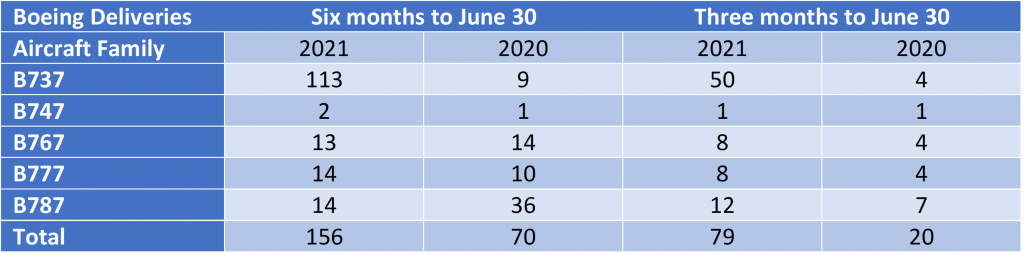

Boeing has delivered 130 B737 Max aircraft since the type was recertified in November 2020. Most of these deliveries came from inventory and new production is at 16/mo with a target increase to 31/mo in early 2022. Of the 387 aircraft already delivered that were grounded in March 2019 190 have returned to service. This shortfall compared to planned production has helped offset the impact of COVID-19 – if Boeing had kept delivering Maxes at 50/mo there would be roughly 1,750 aircraft in service vs the actual 320 as of June 2021. There are still c. 400 Maxes in inventory.

Boeing has also had quality and production problems with the B787, its main passenger twin-aisle product (nearly all B747, B767 and B777 deliveries are freighters or tankers). There are nearly 100 B787s in inventory and its production will temporarily drop from 5/mo to as low as 2/mo. Boeing have not announced any plans to increase the production rate in the future.

Airline Industry Financial Performance

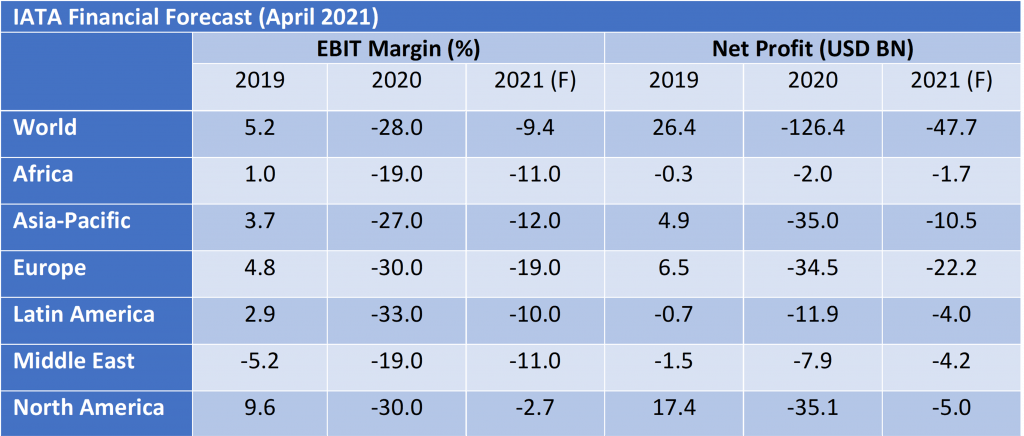

Although IATA’s industry forecast shows a significant year on year improvement in 2021 it will still be the second worst year ever by a considerable margin. Average industry EBIT margin is set to improve from -28% to -9%: the main outliers are North America which is close to break-even at -2.7% and Europe, which is lagging badly at -19.0%. This reflects the relative importance of domestic vs international traffic in these regions, with European short-haul traffic being held back by the lack of a unified approach to safe travel by governments in the first half of 2021.

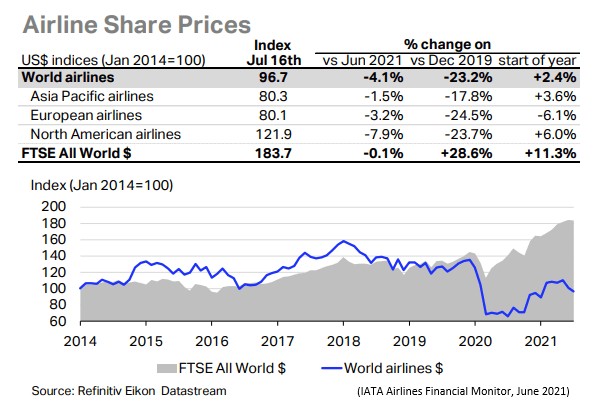

Airline share prices have recovered from their 2020 lows, but the chart below shows that they have underperformed the overall market. This is not surprising given the continued uncertainty over the timing of recovery and the probable requirement to strengthen balance sheets by issuing new equity at the cost of diluting existing shareholders.

Several major airlines have sought court protection in 2021, particularly in the Asia-Pacific region. In February HNA Group filed for bankruptcy and Malaysian Airlines entered a scheme of arrangement in the English courts. In March AirAsia X secured a restraining order with respect to its creditors and Garuda has defaulted on a sukuk financing and is in dispute with some of its aircraft lessors. In Europe the Smartwings Group including Czech Airlines was declared bankrupt in March. Other airlines that remain in restructuring include LATAM, Avianca, Aeromexico, Thai Airways and South African Airways. According to the aviation consultancy Ishka 22 airlines with 1,497 aircraft were under formal restructuring in July 2021.

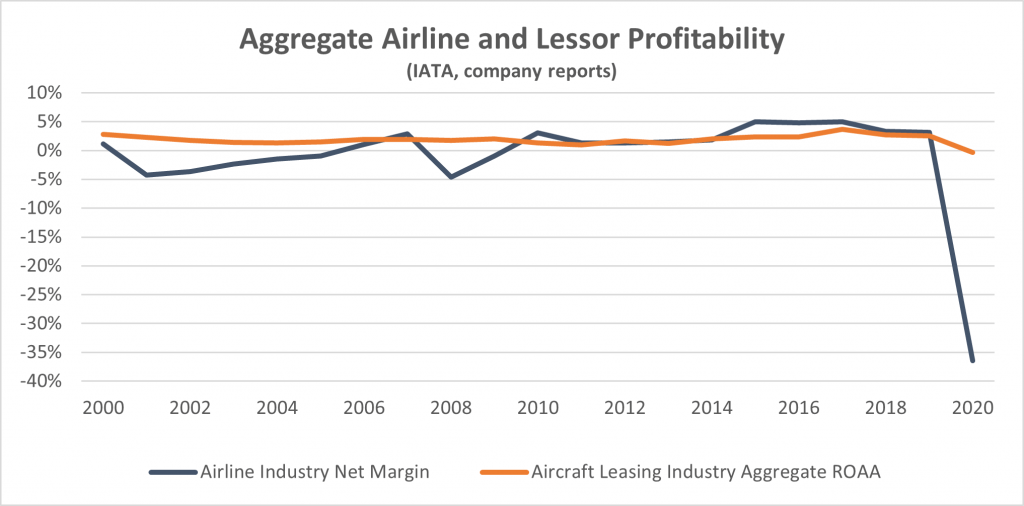

Aircraft Leasing Industry Financial Performance in 2020

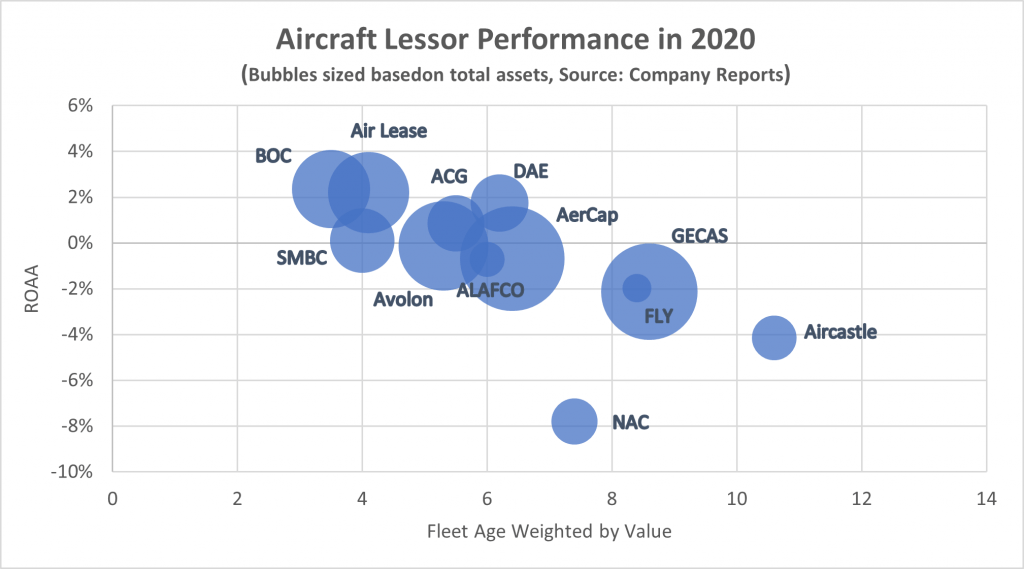

2020 demonstrated the very strong defensive qualities of the aircraft leasing industry compared to the airlines. Sirius tracks the results of all significant lessors with public financial information. The twelve that have reported 2020 results had an aggregate net loss of USD 813M on total average assets of c. USD 220BN, a negative ROAA of 0.4%. Once again, the value of contracted income streams has been clear, and although the initial global impact of the pandemic made geographical credit diversification less valuable, regional airline performance is already showing its historic pattern of significant divergence.

Although credit losses in 2020 were significant, they were less important than asset impairments, particularly impairments relating to twin-aisle aircraft (the market for these aircraft was already suffering from over-supply in 2019). There will undoubtedly be more credit losses in 2021, but it is important not to exaggerate the scale of exposure created by the widespread granting of rental deferrals to assist airlines facing liquidity problems. Total overdue receivables disclosed were USD 1.54BN, 1.2% of total assets for the relevant companies.

Although lessors with younger fleets have done better in terms of profitability it is too early to be definitive about relative performance through the pandemic. The one real outlier is Nordic Aviation Capital (NAC) which has had a very differentiated asset strategy based almost entirely on regional jets and turboprops. NAC had to seek court protection in 2020, as did another lessor, Voyager. Voyager also has a differentiated asset strategy based on twin-aisle aircraft.

There has been minimal evidence of financial distress with other lessors because their assets have included a large percentage of single-aisle aircraft and because they have had a policy of maintaining strong liquidity: AerCap in early 2020 was typical with liquidity equal to twelve months capex and debt repayments.

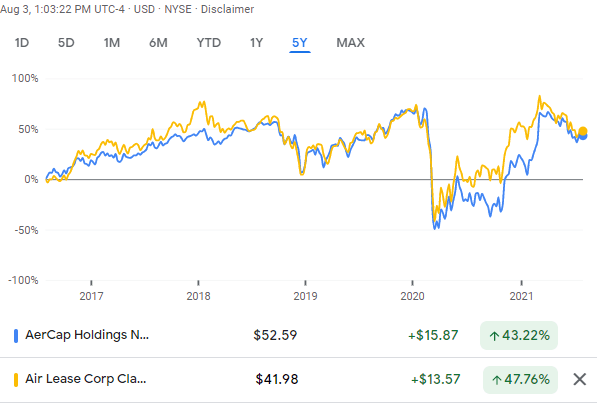

Major aircraft lessor share prices have performed better than those of the airlines, having briefly regained their pre-pandemic levels in early 2021 despite a more recent sell-off. In March AerCap announced that it had agreed to acquire GECAS thus combining the two biggest industry participants, and another important acquisition was announced with Carlyle Aviation acquiring Fly Leasing.

Disclaimer

This document is for informational purposes only. It is not intended as advice or a recommendation with respect to any transaction. The recipient of this document shall be solely responsible for making its own independent investigation and appraisal of any transaction. No market or company data or other information is warranted or guaranteed by Sirius Aviation Capital as to its completeness, accuracy, or fitness for a particular purpose, express or implied, and such data and information are subject to change without notice. Any comments or statements made herein reflect the assumptions, views, and analytical methods of the persons that prepared this document as of its date of preparation, and do not necessarily reflect the views of Sirius Aviation Capital. Sirius Aviation Capital may have issued, and may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Sirius Aviation Capital specifically disclaims any obligation to update this document or any comments or statements contained herein.