Disclaimer: This document and any other materials contained in or accompanying this document (collectively, the “Materials”) are provided for general information purposes only. The Materials are provided without any guarantee, condition, representation or warranty (express or implied) as to their adequacy, correctness or completeness. Any opinions, estimates, commentary or conclusions contained in the Materials represent the judgement of Sirius Aviation Capital Holdings Ltd ( “Sirius”) as at the date of the Materials and are subject to change without notice. The Materials are not intended to amount to advice on which any reliance should be placed and Sirius disclaims all liability and responsibility arising from any reliance placed on the Materials.

Although people who work in aviation acknowledge it is a cyclical industry, we are often vague about what we mean by the term “cyclical”. This presentation introduces proprietary Sirius research that directly measures aircraft supply and demand and how this relates to key macro-economic indicators.

How Do We Measure Aircraft Supply and Demand?

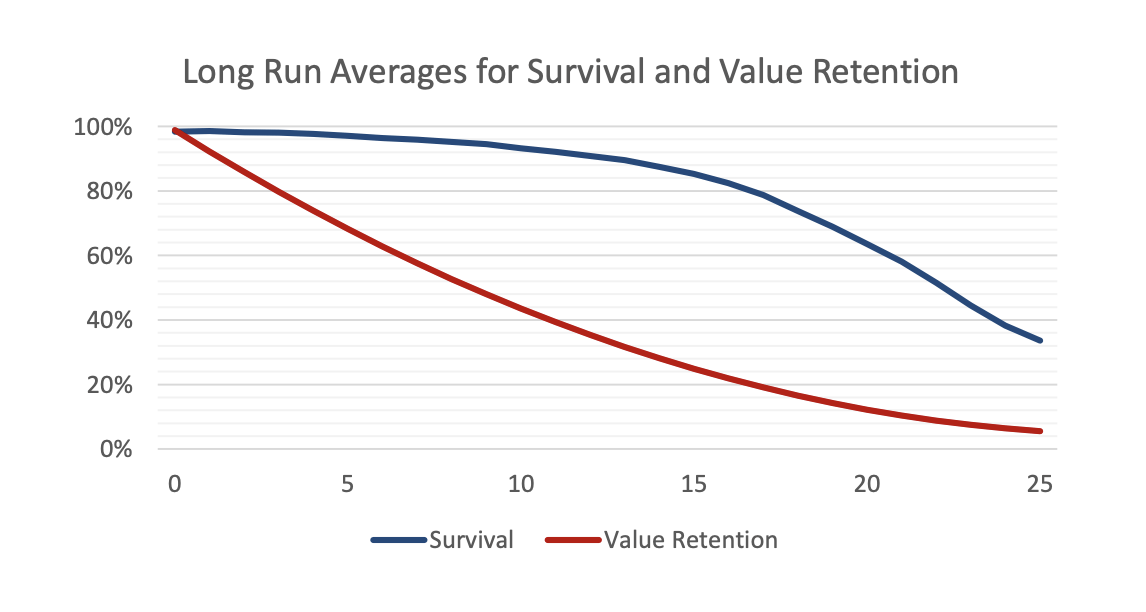

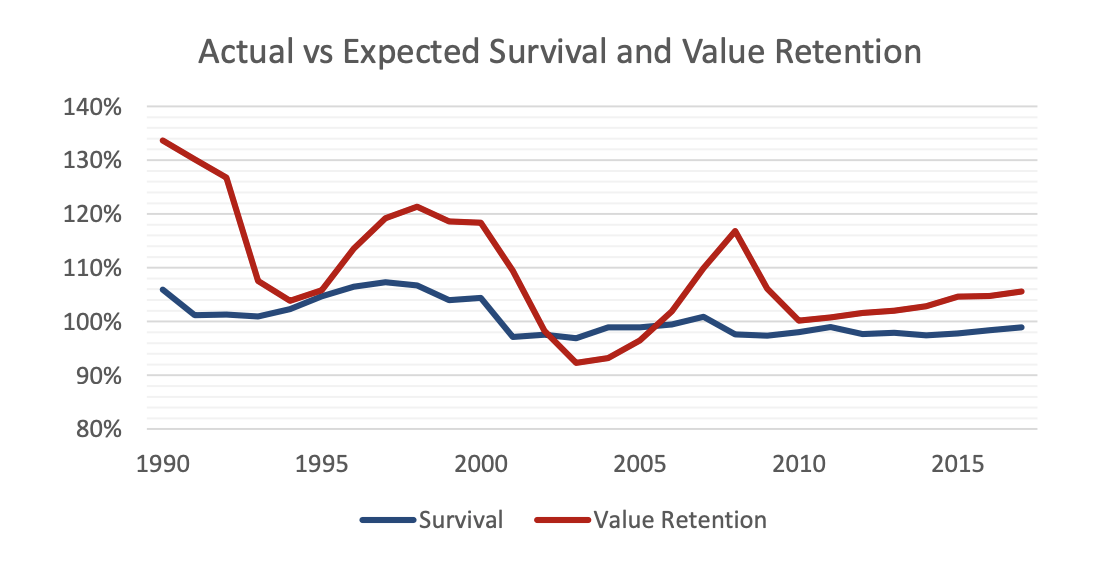

- Two key measures or aircraft economic utility

- Survival – how many passenger aircraft remain in passenger service by age

- Value retention – used aircraft values as %age of replacement cost

- We can track changes in supply and demand by comparing actual survival and value retention with expected values based on long-run averages

- Correlation analysis suggests that both measures are reflecting the same market dynamics

- Measures of aircraft supply and demand are highly correlated – 81% with a one year lag on value measure

- Correlation holds up at aircraft class level despite distinct cycles – 83% for single-aisle, 72% for twin-aisle

Sources: Avitas, Flight Fleets Analyzer, In-house Estimates Data excludes early technology aircraft e.g. B707/DC8 and 50 seat regional jets

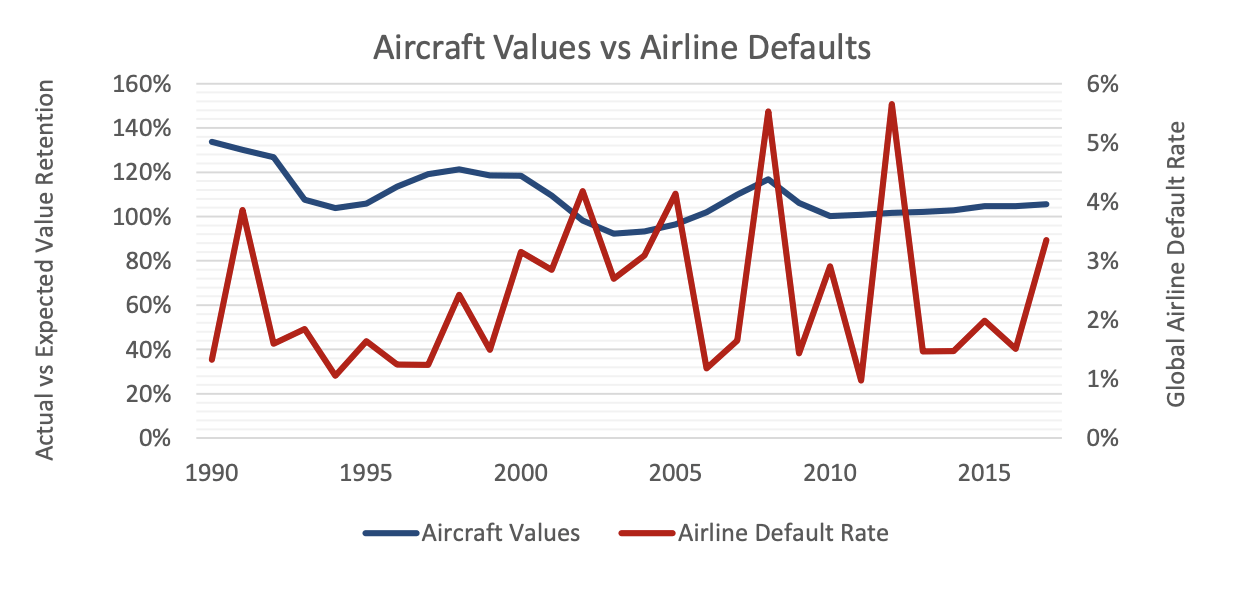

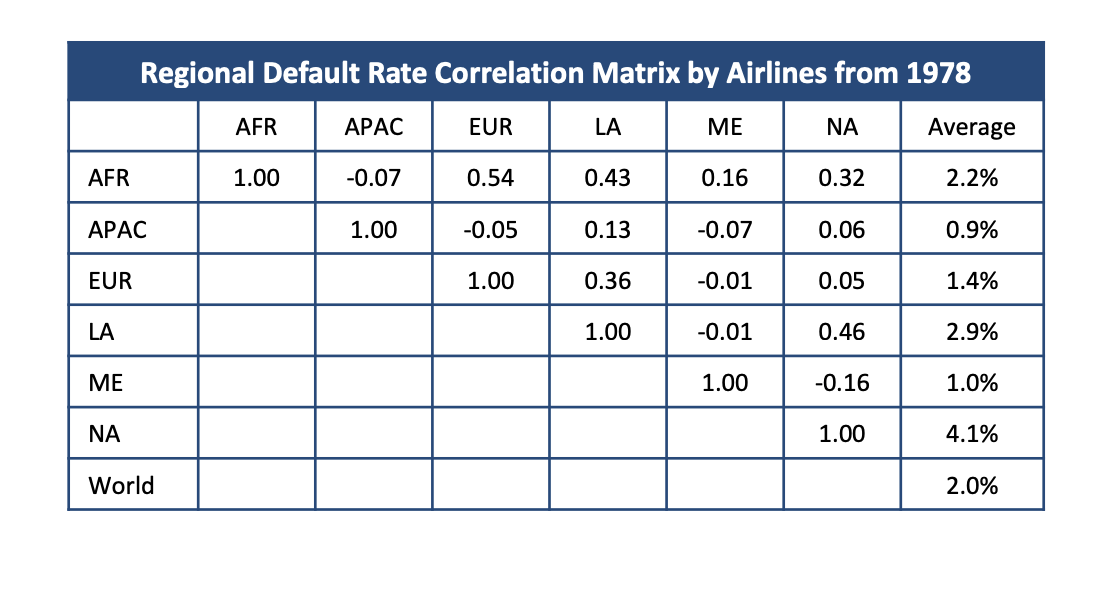

The Aircraft Cycle is Not the Same as the Airline Cycle

- Conventional wisdom is that airlines always default when aircraft values are weak, and is the result of assuming North America is good proxy for the global airline industry

- Actual correlation between aircraft values and airline defaults is the right way round but not meaningful at -0.11

- Aircraft values are the function of a global market and are influenced by deliveries as well as traffic growth

- Airline default rates are sensitive to local economic conditions and idiosyncratic factors and are not strongly correlated by region

Sources: Avitas, Flight Fleets Analyzer (aircraft fleet statistics for passenger aircraft only). Default statistics based on in-house industry study.

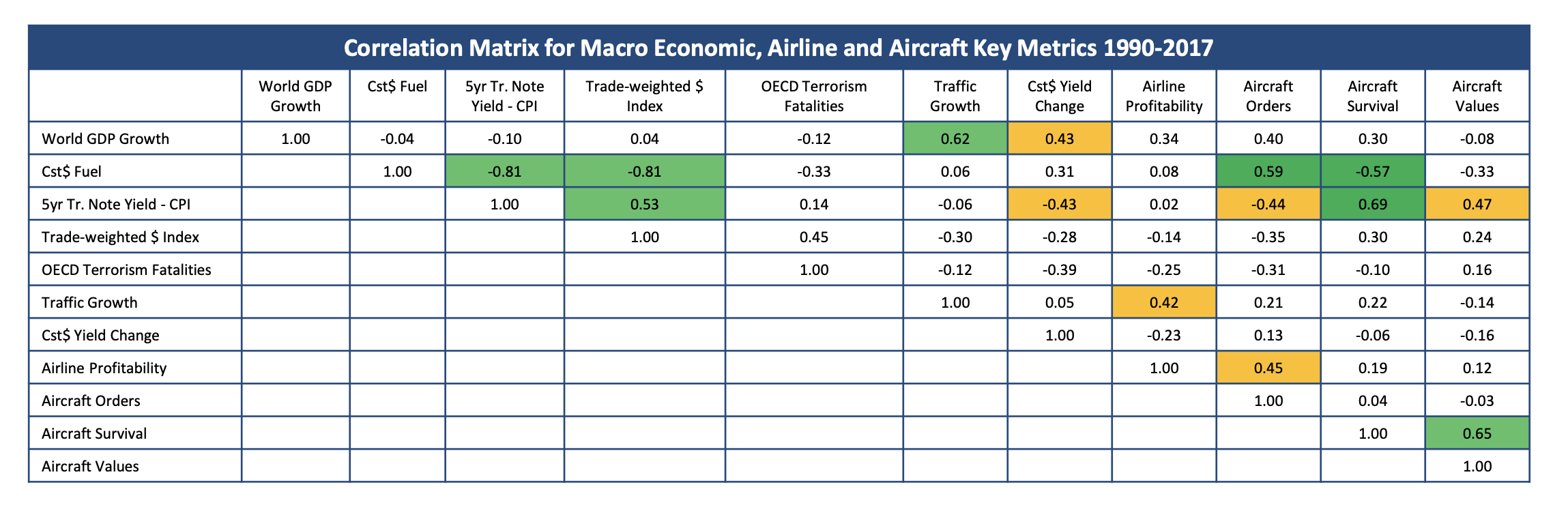

Impact of Macro Economic Factors

- Fuel prices and interest rates have an impact on aircraft orders and values

- Low fuel prices are good for used aircraft values as they reduce the benefit of new technology and discourage new aircraft orders

- High-interest rates are good for used aircraft as they increase ownership costs which are more interest rate sensitive for new aircraft

Correlation of greater than 0.5/-0.5

Correlation of greater than 0.4/-0.4

Sources: Airline Monitor, Avitas, Flight Fleets Analyzer, various US government statistical bodies, University of Maryland Global Terrorism Database